Exploring Medicare Advantage Plans

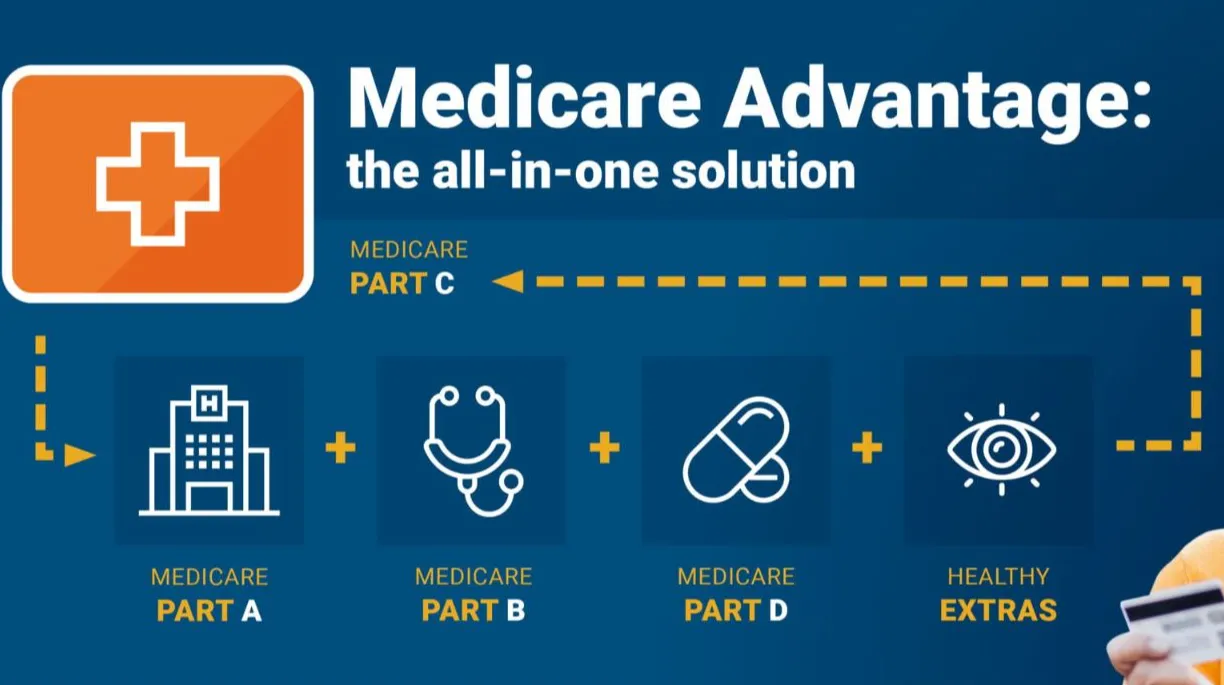

Medicare Advantage Plans are offered by independent Insurance carriers that contract with Medicare to deliver Part A together with Part B coverage in one coordinated structure. Different from Original Medicare, Medicare Advantage Plans often offer extra benefits such as prescription coverage, dental care, eye care services, together with wellness programs. These Medicare Advantage Plans function within established geographic boundaries, which makes residency a critical consideration during review.

Ways Medicare Advantage Plans Vary From Original Medicare

Original Medicare provides open medical professional choice, while Medicare Advantage Plans generally operate through managed care networks like HMOs in addition to PPOs. Medicare Advantage Plans may include referrals as well as in-network providers, but they often balance PolicyNational.com Medicare Advantage those restrictions with consistent expenses. For countless beneficiaries, Medicare Advantage Plans offer a middle ground between budget awareness along with enhanced services that Original Medicare alone does not usually provide.

Which individuals Might Consider Medicare Advantage Plans

Medicare Advantage Plans attract individuals seeking organized care & possible financial savings under one plan structure. Seniors managing ongoing health conditions often select Medicare Advantage Plans because integrated care models streamline ongoing care. Medicare Advantage Plans can additionally attract individuals who desire packaged benefits without handling several secondary plans.

Eligibility Guidelines for Medicare Advantage Plans

To be eligible for Medicare Advantage Plans, enrollment in Medicare Part A along with Part B required. Medicare Advantage Plans are available to most people aged sixty-five along with older, as well as under-sixty-five people with eligible medical conditions. Enrollment in Medicare Advantage Plans is based on living status within a plan’s service area as well as enrollment timing that matches permitted enrollment periods.

Best times to Enroll in Medicare Advantage Plans

Timing holds a vital function when enrolling in Medicare Advantage Plans. The Initial sign-up window surrounds your Medicare qualification milestone with permits initial choice of Medicare Advantage Plans. Missing this timeframe does not automatically end eligibility, but it does limit future opportunities for Medicare Advantage Plans later in the year.

Annual with Special Enrollment Periods

Each fall, the Annual enrollment window permits beneficiaries to change, remove, with enroll in Medicare Advantage Plans. Qualifying Enrollment Periods open when qualifying events happen, such as moving with loss of coverage, making it possible for changes to Medicare Advantage Plans beyond the normal schedule. Knowing these windows supports Medicare Advantage Plans remain available when circumstances shift.

How to Review Medicare Advantage Plans Successfully

Evaluating Medicare Advantage Plans involves attention to more than monthly premiums alone. Medicare Advantage Plans change by network structures, out-of-pocket maximums, drug lists, & coverage guidelines. A careful analysis of Medicare Advantage Plans assists aligning medical priorities with coverage models.

Expenses, Coverage, also Provider Networks

Recurring costs, copayments, in addition to annual caps all shape the overall value of Medicare Advantage Plans. Certain Medicare Advantage Plans include low premiums but elevated out-of-pocket expenses, while alternative options prioritize stable spending. Provider availability also changes, which makes it essential to confirm that preferred providers participate in the Medicare Advantage Plans under consideration.

Drug Benefits as well as Extra Benefits

A large number of Medicare Advantage Plans provide Part D prescription coverage, simplifying prescription management. In addition to medications, Medicare Advantage Plans may cover wellness programs, ride services, and/or over-the-counter benefits. Reviewing these extras supports Medicare Advantage Plans align with everyday medical priorities.

Joining Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can take place digitally, by phone, and also through authorized Insurance Agents. Medicare Advantage Plans call for correct individual information and verification of eligibility before activation. Completing enrollment carefully helps avoid delays and also unplanned benefit interruptions within Medicare Advantage Plans.

The Importance of Authorized Insurance Agents

Authorized Insurance Agents assist explain plan specifics & outline differences among Medicare Advantage Plans. Speaking with an expert can address provider network restrictions, coverage boundaries, along with costs linked to Medicare Advantage Plans. Expert assistance frequently accelerates decision-making during sign-up.

Typical Missteps to Prevent With Medicare Advantage Plans

Missing doctor networks details ranks among the most errors when selecting Medicare Advantage Plans. A separate problem involves focusing only on monthly costs without reviewing annual spending across Medicare Advantage Plans. Reading coverage materials carefully prevents confusion after enrollment.

Reevaluating Medicare Advantage Plans Every Year

Medical needs shift, with Medicare Advantage Plans adjust annually as well. Reassessing Medicare Advantage Plans during open enrollment periods permits changes when coverage, expenses, even providers shift. Ongoing evaluation ensures Medicare Advantage Plans aligned with existing healthcare needs.

Why Medicare Advantage Plans Continue to Expand

Participation patterns indicate increasing engagement in Medicare Advantage Plans nationwide. Expanded coverage options, defined out-of-pocket caps, in addition to integrated care help explain the appeal of Medicare Advantage Plans. As choices multiply, educated evaluation becomes even more important.

Ongoing Value of Medicare Advantage Plans

For a large number of beneficiaries, Medicare Advantage Plans offer reliability through integrated coverage also organized care. Medicare Advantage Plans can minimize administrative complexity while encouraging preventive care. Identifying well-matched Medicare Advantage Plans creates confidence throughout later life years.

Review not to mention Sign up for Medicare Advantage Plans Now

Taking the next move with Medicare Advantage Plans starts by examining current options and verifying eligibility. Whether you are currently entering Medicare and/or revisiting current coverage, Medicare Advantage Plans offer versatile solutions designed for varied medical needs. Review Medicare Advantage Plans now to secure a plan that aligns with both your health and also your financial goals.